While any parcel of land has some intrinsic value as a real asset, you are much more likely to be approved for a loan if you can show that it also has value as an investment. The most important of these is the land itself, its location, and how it will be used. There are a number of variables that can influence your financing options when buying a piece of land. Banks also tend to charge a higher rate of interest to offset the additional risk. Consequently, land loans can be more difficult to obtain, particularly if you don't have a definite plan in place to improve the property and increase its value. People are much more likely to walk away from a land loan than a mortgage, potentially leaving the lender with an unimproved parcel of land which they will have to sell to recoup their losses. Undeveloped land, on the other hand, doesn't deliver the same degree of investment security for the creditor. Moreover, a house on a lot has greater value on the open market, and makes for a more secure form of collateral. Borrowers are much less likely to walk away from a home loan, particularly if the property is being used as a primary residence. But a short primer should help you understand how land loans work, and what your options are when looking for a lender.īanks and other lenders tend to view land loans with a wary eye, and consider them to be more of a risk than a standard mortgage.

If you've never purchased land before, you may find the process a bit more challenging than you expected. Land loans are unique financial products, and they are handled differently than mortgages and other secured loans. But borrowing money to purchase raw land is not quite that straight forward. Unless you're in a position to pay cash up front, you'll need to borrow some money to finance the purchase. Monthly private mortgage insuranceThe monthly amount you will be required to pay by the lender for private mortgage insurance (PMI).Everything You Need to Know About Land Loansīuying a parcel of land, either as a long term investment or on which to build a new home, is not quite as simple as you might think.Annual hazard insuranceThe annual amount you expect to pay for hazard/homeowner's insurance.Annual property taxesThe annual amount you expect to pay for property taxes.If you would like to specify these values, select 'No' Let system estimate property taxes, insurance, and private mortgage insurance?Select 'yes' if you want the calculator to estimate these values for you based on national averages.Purchase price of propertyThe selling price of the home you are selling, if applicable.You can control whether you want it to display year-by-year or month-by-month. Desired amortization scheduleAfter clicking Submit, an amortization schedule will be shown.

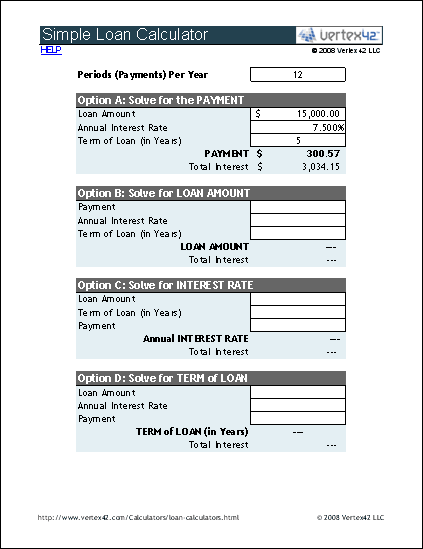

30 years = 360 months, 20 years = 240 months, 15 years = 180 months. Number of months The number of months you wish to finance this home mortgage loan.Annual interest rateThe interest rate for this home mortgage loan.Proposed mortgage loan amountThe amount you wish to borrow for your home mortgage.A mortgage calculator can assist you when buying a home as well. The old adage that the three most important attributes of real estate are "location, location, and location" is worth remembering when you buy a home. The good news is that most people who incur capital gains upon the sale of their personal residences will not have to pay tax on the gains, due to the current exemption limits.

60000 interest only mortgage calculator plus#

Your cost basis will be the principal amount you paid for the property, plus the value of any substantial capital improvements (e.g., building a patio, additional bedroom, etc.) you may have invested in, but not including the cost of ordinary repairs and upkeep. Your capital gain is the amount you sell your home for, minus your cost basis. This increase in value can result in a capital gain to you when you sell your home. Unlike with many other kinds of investments, there are a number of things you can do to increase the investment value of your home.

0 kommentar(er)

0 kommentar(er)